Most Effective Government Contractor Timekeeping

As most government contractors know, DCAA is extremely serious about effective and accurate timekeeping. In short, your government contractor timekeeping must be perfect. In the few instances that one of our clients failed to have their accounting system approved, it was caused by their timekeeping being less than perfect.

The two criteria included on the SF1408 are:

- A timekeeping system that identifies employee’s labor to the appropriate cost objectives

- A labor distribution system that charges direct and indirect labor to the appropriate cost objectives

So this means that the employees must be able to choose the correct place to charge their hours each day. To do this, the employees must be instructed about their available charges. Of course, if you have an electronic system, you could bracket the available charges so that you limit access to incorrect charges.

Then, the audit trail for labor charges must have integrity: the hours and dollars must match. The labor audit trail is the flow of data, documents, and reports relative to labor charges and costs.

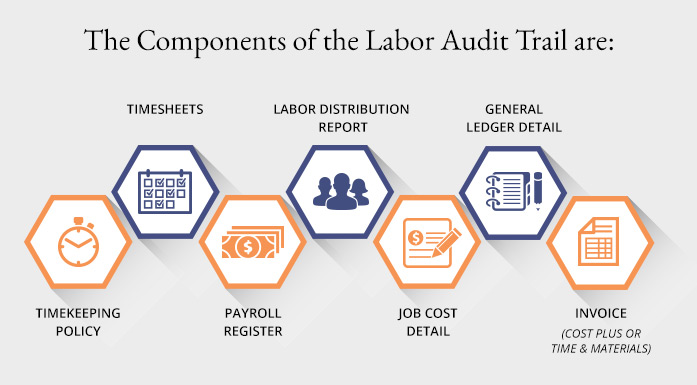

The components of the labor audit trail are:

Timekeeping Policy >Timesheet > Payroll Register > Labor Distribution Report > Job Cost Detail > General Ledger Detail > Invoice (Cost Plus or Time & Materials).

This means that if an employee charges 97.5 hours to a contract in an accounting period, those 97.5 hours must be evident in each and every component of the audit trail. If the timesheet and invoice to the Government show 97.5 hours, but the payroll register shows 97, there is a problem. It shows the auditor that there is a deficiency in your labor tracking system. Any invoice that goes out the door must be supported by a report from your accounting system and the numbers on the two must match exactly.

There are two types of mistakes to be conscious of: those made within the pay period and discovered and corrected by the employee, and those discovered by supervisors further up the chain. For either type, the process of handling any mistakes must be documented in your timekeeping polices and followed without flaw. Corrections should be made within a pay period. If this for some reason is not possible, ensure that the correction goes through in a subsequent period. Put a note on your calendar. You don’t want your entire accounting system to fail because you forgot to get the correcting timesheet posted to your system.

Also important is the certification and authorization processes. For timesheets to be considered valid, the employee must certify the timesheet as accurate at the end of each pay period by signing it. In addition, a supervisor must authorize the timesheet as correct by signing it. With electronic timesheets, certification and authorization are done with processes built into the software.

Using an electronic timekeeping system for your government contractor timekeeping will provide the following advantages:

- Increased efficiency and shortened process times: 50 employees spending one hour per pay period versus one employee spending 50 hours on data entry.

- Improved accuracy: no errors from double entry or wrong interpretations because data is transmitted electronically. No human hands after certification.

- Improved quality control: employees must pick charges from a list of “available” direct and indirect labor charges.

- Other criteria important when choosing an electronic timekeeping system are:

- The electronic timesheet software integrates with your accounting software, whether Deltek or QuickBooks.

- If using QuickBooks, the timesheet software should track a field that maps to the QuickBooks payroll items field; otherwise you will not eliminate double-entry completely.

- You can check during the pay period to see which employees are not up-to-date on making their labor charges.

- The system, including implementation, is cost beneficial.

- There is effective support from the software vendor.

If you have questions or need any assistance in developing timekeeping policies, timekeeping system setup or modification, or government contractor timekeeping, please contact us.

KDuncan & Company is dedicated to providing knowledge and support for small government contractors about concerns regarding government contracting. For questions on areas such as as cost proposals, accounting systems, DCAA compliance, and incurred cost audits, reach out to KDuncan & Company.