DCAA Approval – A Checklist for Success

A Defense Contract Audit Agency (DCAA) audit is an evaluation of a condition within your company measured against particular government standards and/or regulations. This post will address the types of DCAA audits, the conditions that initiate them, the purpose of the audit, and how to prepare. Below is a list of the various types of DCAA audits in order of the life cycle of a typical contractor, along with some helpful tips to ensure DCAA approval.

Preaward Pricing Proposal Review

Condition: The contractor has submitted a cost proposal on a Federal Acquisition Regulations (FAR) Part 15, Negotiated Contract procurement.

Purpose: To determine if the proposed pricing in the cost proposal is fair and reasonable. Pricing is considered fair and reasonable if there is adequate competition or if the pricing is based on projected costs that are reasonable, allocable, and allowable per the FAR. The auditor will examine the contractor’s basis and support for the projected costs. Ultimately, the auditor will produce information for the government to project the real price of your cost proposal. For the contractor, this could determine win versus loss of this procurement.

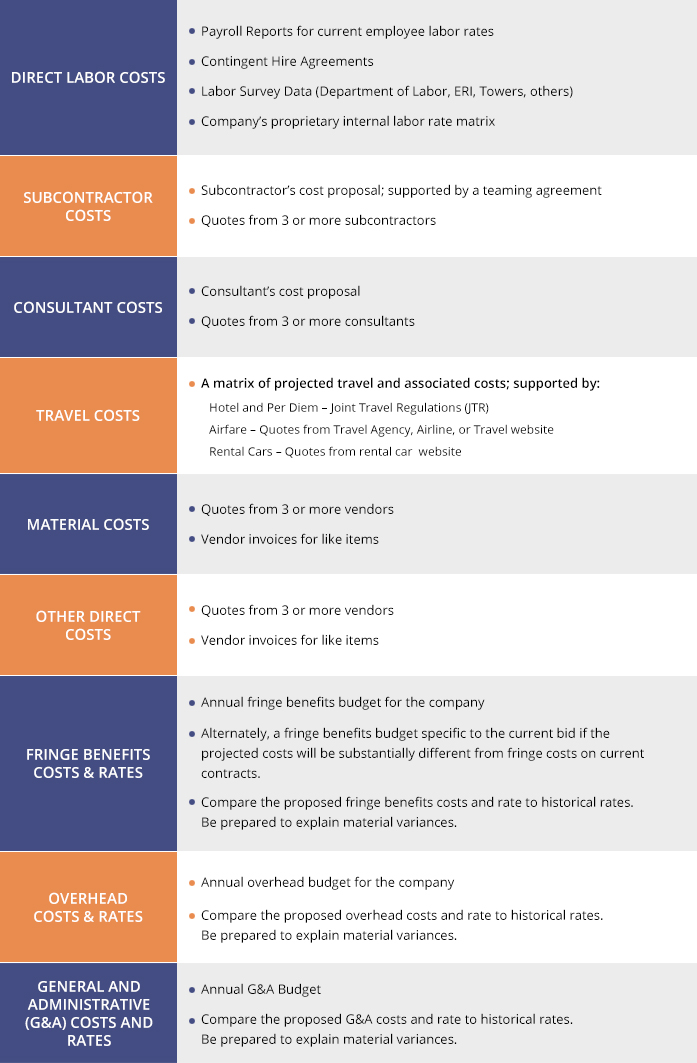

Preparation: Proposed costs should have a valid basis with supporting documentation for DCAA approval. The ideal would be to treat every cost proposal as if the Government is referencing FAR Table 15-2 and requiring detailed support (see below).

Preaward Accounting System Review

Condition: The contractor has submitted a cost proposal on a cost reimbursable contract under FAR Part 15, Negotiated Contract procurement. Both cost plus and time and material (T&M) are considered cost reimbursable contracts.

Purpose: The auditor’s job is to evaluate the design of contractor’s accounting system to determine if it is adequate for prospective contract. Per FAR 9.104-1(e), to be determined responsible, the contractor must have the necessary accounting and operational controls in place. The auditor uses the SF1408 from FAR Part 53 as a guideline. The form is a checklist of criteria. The auditor must check “Yes” to all applicable criteria or you and your system fail the review. When you pass, you will move forward to the next step of the procurement process. Note: With DCAA approval, we find that most contractor deficiencies occur in the area of timekeeping.

Preparation: Get guidance in setting up your accounting system from an accounting professional that is familiar with FAR Part 31 and the SF1408. Design and develop effective written accounting policies and procedures. Have a mock audit conducted in preparation for the DCAA audit. Make the necessary corrections before the audit begins.

Financial Capability Review

Condition: The contractor has submitted a cost proposal on a Federal Acquisition Regulations (FAR) Part 15, Negotiated Contract procurement. The contracting officer has concerns that the contractor may not have the financial resources required to successfully operate the contract.

Purpose: Under FAR 9.104-1, decisions on contractor responsibility must consider whether the offeror has adequate financial resources or the ability to obtain them. The auditor’s job is to collect financial information to determine if the potential contractor has the financial capability required to perform the contract. The auditor will request financial statements and conduct a financial analysis on them. The auditor will focus on 8 key financial ratios.

Preparation: The contractor should monitor its financial statements and financial ratios on a regular basis and make financial decisions that will maintain a healthy financial condition. Key items for DCAA approval to monitor are:

- Equity on the Balance Sheet. It needs to maintain a positive amount.

- The current ratio. It needs to be above 1.0.

- The debt to equity ratio. It should be 3.0 or below.

Floorcheck Review

Condition: The contractor has a cost reimbursable contract or contracts with a substantial number of employees.

Purpose: To evaluate the accuracy of contractor employees (salaried and/or hourly) labor hour charges to contracts, indirect accounts, or other cost objectives. Typically, this review is done without prior notification. This could determine the level of scrutiny the government uses in reviewing billings or whether the government chooses to continue your current costs reimbursable contracts.

Preparation: The contractor should design and maintain and effective timekeeping and labor distribution system for DCAA approval. Design and develop effective written timekeeping policies and procedures. There should be a system of self-monitoring, control, and correction in place.

Incurred Cost Audit

Condition: The contractor is performing on cost reimbursable contracts and is required to submit an annual incurred cost submission.

Purpose: To evaluate the accuracy of the incurred cost submission; ultimately determining whether you have under-billed or over-billed the government. The auditor will conduct transaction testing of your general ledger and the support documents available to support the transactions to determine the total costs per contract with indirect costs applied. An important aspect is the determination of allowability, allocability, and reasonableness of costs. Note: retaining source documents is of vital importance in these engagements. This will determine whether you owe money to the government or the government owes you.

Preparation: The contractor should prepare invoices to the government based on information provided by its accounting system. Thus, the invoices will be reconciled to the contractor’s general ledger. An effective filing and record retention system is vital. Cost will be considered valid only if the auditor can substantiate them. The review of the source documents is required for DCAA approval.

KDuncan & Company LLC (KDC) is a Licensed Certified Public Accounting and Financial Services firm that provides support to agencies of the federal government and government contractors. KDuncan has more than 30 years of experience with DCAA approval and has a 98% success rate in getting clients’ accounting systems approved by DCAA. Learn more about our services.

KDuncan & Company is dedicated to providing knowledge and support for small government contractors about concerns regarding government contracting. For questions on areas such as as cost proposals, accounting systems, DCAA compliance, and incurred cost audits, reach out to KDuncan & Company.