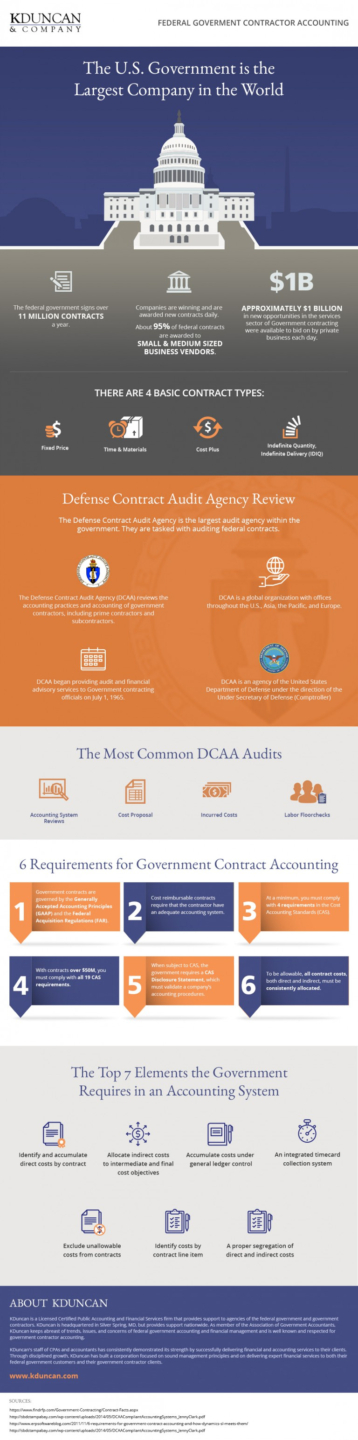

The U.S. government is the largest company in the world.

The federal government signs over 11 million contracts a year. Companies are winning and are awarded new contracts daily. About 95% of federal contracts are awarded to small and medium sized business vendors. Approximately $1 billion in new opportunities in the services sector of government contracting were available to bid on by private businesses each day.

There are 4 basic contract types.

They are:

- Fixed price

- Time and materials

- Cost plus

- Indefinite quantity/indefinite delivery (IDIQ)

Defense Contract Audit Agency (DCAA) Review

The Defense Contract Audit Agency (DCAA) is the largest audit agency within the government. They are tasked with auditing federal contracts.

The DCAA reviews the accounting practices and accounting of government contractors, including prime contractors and subcontractors. DCAA is a global organization with offices throughout the US, Asia, the Pacific, and Europe. DCAA began providing audit and financial advisory service to government contracting offices in July 1st, 1965. DCAA is an agency of the United States Department of Defense under the direction of the Under Secretary of Defense (Comptroller).

The Most Common DCAA Audits

The most common DCAA audits are:

- Accounting system reviews

- Cost proposals

- Incurred costs

- Labor floorchecks

There are 6 requirements for government contract accounting.

- Government contracts are government by the Generally Accepted Accounting Principles (GAAP) and the Federal Acquisition Regulations (FAR).

- Cost reimbursable contracts require that the contractor have an adequate accounting system.

- At a minimum, you must comply with 4 requirements in the Cost Accounting Standards (CAS).

- With contracts over $50 million, you must comply with all 19 CAS standards.

- When subject to CAS, the government requires a CAS Disclosure Statement, which must validate a company’s accounting procedures.

- To be allowable, all contract costs, both direct and indirect, must be consistently allocated.

The top 7 elements the government requires in an accounting system are:

- Identify and accumulate direct costs by contract

- Allocate indirect costs to intermediate and final cost objectives

- Accumulate costs under general ledger control

- An integrated timecard collection system

- Exclude unallowable costs from contracts

- Identify costs by contract line item

- A proper segregation of direct and indirect costs

About KDuncan

KDuncan & Company LLC (KDC) is a Licensed Certified Public Accounting and Financial Services firm that provides support to agencies of the federal government and government contractors. KDuncan is headquartered in Silver Spring, MD, but provides support nationwide. As member of the Association of Government Accountants, KDC keeps abreast of trends, issues, and concerns of federal government accounting and financial management and is well known and respected for government contractor accounting. Learn more about KDuncan’s services >

KDC’s staff of CPAs and accountants has consistently demonstrated its strength by successfully delivering financial and accounting services to their clients. Through disciplined growth, KDC has built a corporation focused on sound management principles and on delivering expert financial services to both our federal government customers and their government contractor clients.